Interval Funds are an increasingly popular way for investors to access alternative investments. Managers like the interval structure as a route to more retail-oriented assets while staying true to their investment processes. Investors like the funds as a means to access alternative strategies that offer low correlation to traditional investments. The features of the Interval Fund structure, a hybrid between private funds and mutual funds, is what makes them so appealing.

Industry Growth

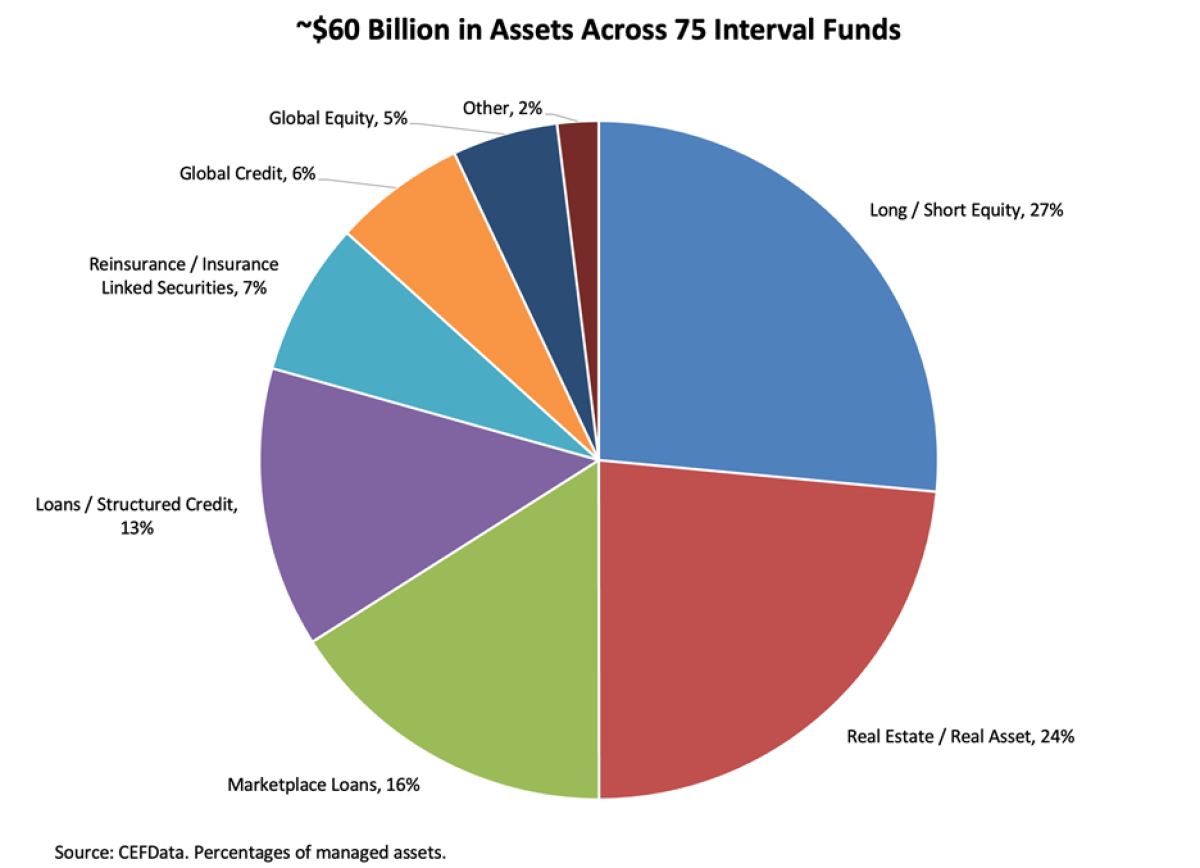

Although the SEC officially authorized Interval Funds in 1992, it took another 20 years before their issuance became commonplace. According to CEFData, on June 30, 2017 there were 27 Interval Funds with approximately $15 billion in managed assets in aggregate. Today, less than 5 years later, there are 75 funds, most with multiple share classes, managing just over $60 billion. A group of funds that essentially didn’t exist a decade ago have attracted assets at a 32% compounded annual growth rate since mid-2017. Investors’ increasing interest in gaining alternative-asset exposure explains both the increase in funds and the growth of assets.

Features of both private funds and mutual funds

Interval Funds are legally classified as closed-end funds. However, because Interval Funds are unlisted securities (not available to trade on a stock exchange), they have no share price. Unlike traditional closed-end funds, there is no “discount to NAV,” which many investors find appealing. All share purchases and sales are conducted at NAV.

Rather than comparing Interval Funds with traditional closed-end funds, many investors find it more instructive to consider them as a bridge between private funds and open-end mutual funds (“mutual funds”). The similarities to mutual funds include:

- Share transactions are conducted directly with the fund

- Investors have the ability to purchase shares on a continuous (i.e., daily) basis, in most cases

- Funds strike a daily NAV, which is unusual given their underlying assets but required for continuously offering shares at NAV

- Minimum investment requirements are relatively low, generally around $50,000 though many funds have a $1,000 minimum

- Like all “’40 Act” funds, Interval funds offer a high degree of transparency and oversight, strict compliance requirements, required regular reporting, and an independent Board of Trustees

The main differences with mutual funds are broader portfolio investment allowances and lower liquidity (“selling shares”) capability. This is where the bridge to private funds comes in.

Alternative investment portfolios are, by their nature, illiquid. If a manager’s portfolio is structured around venture capital investments, there is no way to efficiently meet shareholders’ volatile cash inflow/outflow demands. This is why mutual funds are restricted to holding less than 15% of portfolio assets in illiquid securities. The Interval Fund structure allows managers to control cash outflows, providing a means to offer investors some liquidity but allowing portfolios to fully invest in illiquid, alternative assets.

“Interval funds were developed for long-dated assets. The assets that we are buying in our interval fund, private equity assets, we typically hold those for three to six years. However, the traditional investor wants to have liquidity more often than every three to six years. The interval fund structure allows us to bridge that gap between long-term investing and near-term liquidity for our investors. That’s the design.”

–Michael Bell, Primark Private Equity Investments Fund

Interval Funds derive their name from the fact that, at certain intervals (usually quarterly), the funds repurchase shares through tender offers. The SEC mandates this – it isn’t a feature that the funds can choose to turn off. The funds do have control over some items, such as the amount of fees charged for repurchasing (capped at 2%) and the size of the offer (usually around 5% of shares outstanding). This is conceptually similar to private funds’ “lock up” periods.

Democratization of institutional investment strategies

Through Interval Funds, investors are able to access alternative assets in a way that offers better transparency and liquidity than investing in a private fund and better alternative exposure than would be possible in a mutual fund. As Flat Rock Global’s CEO, Robert Grunewald, explains in regard to middle market loan investing: “the reason we have the interval fund structure is that middle market loans are less liquid. And what investors are doing is picking up the illiquidity premium that exists in the marketplace for middle market debt.” Mutual fund investors would not be able to access middle-market debt and the illiquidity premium; Interval Fund investors can.

“At CEF Advisors we build portfolios of traditional CEFs, BDCs and Interval Funds for clients. The interval fund allocations are designed to increase access to private equity and debt allocations, while reducing portfolio volatility. We ‘increase’ our interval fund allocations when discounts for traditional funds are narrow and reduce allocations when discounts widen dramatically, if warranted. These funds are valuable tools in our work on behalf of clients seeking high-quality active management”

–John Cole Scott, chief investment officer, Closed-End Fund Advisors

Many funds, many choices

Because of their increasing popularity in recent years, investors today have several options for accessing various alternative investments within an Interval Fund structure.

Understanding Interval Funds is arguably more important than ever. Investors are concerned about rising rates and the effect on traditional bond portfolios, which we are witnessing daily. More investors should know that there are funds available that offer alternative, uncorrelated income and returns that can help diversify risk. Despite their growth over the past several years, Interval Funds’ popularity shows no sign of slowing down. Broader awareness and understanding are the only things reining in even more stellar growth.